BootstrapLabs Acquired by Ares Management

On February 1st, 2024 Ares Management Corporation (“Ares”, NYSE: ARES), a leading global alternative investment manager with over $428 billion in assets under management[1], closed on its acquisition of BootstrapLabs to accelerate and enhance Ares’s AI strategy. In addition to managing a leading AI-first venture capital strategy, the BootstrapLabs team has formed the foundation of the Ares AI & Innovation Group which will seek to build proprietary AI solutions and partner with industry-leading vendors to help drive efficiencies for Ares’ portfolio companies, assets and certain investment processes and business operations.

Nicolai Wadstrom and Benjamin Levy have been named Partners and Co-Heads of the Ares Venture Capital and AI & Innovation Groups.

Ares recognized that BootstrapLabs was among the first U.S.-based venture capital firms to invest solely in AI technology start-ups, with deep AI investment experience dating back to 2015. With over 30 early-stage AI-first portfolio companies and differentiated access to top founders, we believe BootstrapLabs is well positioned to help drive value for key stakeholders across both venture capital and AI value creation functions.

BootstrapLabs History

BootstrapLabs was founded in 2008 and grew out of the vision of Nicolai, a serial tech entrepreneur. He wanted to turn his private investment firm into a software-focused venture capital manager leveraging the power of the entrepreneurial community in the Bay Area to support founders as they scale their startups from 0 to 1 and from 1 to 100.

In 2012, after becoming good friends and sharing their passion for entrepreneurship and their interest in how technological innovation can have a positive impact on individuals, companies, and society, Benjamin, an entrepreneur and former investment banker, joined BootstrapLabs in a co-founding capacity.

Following some early successes investing in software companies , BootstrapLabs realized that AI was beginning to create utility value for businesses. They also believed that AI was riding on the back of major high growth secular trends including networking, computing, data and digitalization. As a result, in late 2015, the firm established an early-stage investment strategy focused exclusively on Applied AI technology startups and closed its first institutional venture capital fund.

BootstrapLabs’ investment strategy focused mainly on the enterprise application layer, in major sectors such as Future of Work, Mobility, Health, Digital Infrastructure, Financial Infrastructure and Climate & Energy.

BootstrapLabs uses its community engagement approach to enable a differentiated venture capital investment platform. The firm has made more than 70 investments in over 30 AI-first companies and is investing from its third Applied AI fund.

Ares & BootstrapLabs

Over three years ago, Nicolai had an initial conversation with Michael Arougheti, CEO, President and Co-Founder of Ares, following an introduction by a mutual friend and left the meeting feeling an instant connection with Ares’ collaborative and entrepreneurial culture. Moreover, Nicolai believed the benefits of a large, global platform could allow BootstrapLabs to significantly broaden the scale of its impact.

Subsequent meetings made it very clear that joining forces would create an exciting opportunity to create value by leveraging a nearly decade-long investment history in AI and of one of the largest global alternative investment managers.

While the next phase of the journey is just beginning, the BootstrapLabs’ team is excited to be partnered with Ares as the opportunity AI presents continues to evolve and unfold.

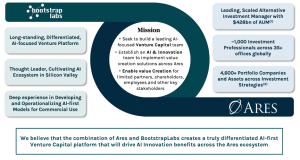

Below is a high-level overview of our combined firms:

[1] AUM as of March 31, 2024. AUM amounts include funds managed by Ivy Hill Asset Management, L.P., a wholly owned portfolio company of Ares Capital Corporation and registered investment adviser.

[2] Includes active investments in ~1,750 companies, ~1,400 alternative credit investments, ~70 private equity investments, ~500 properties, ~65 infrastructure assets, and ~820 limited partnership interests as of March 31, 2024.